Several yet , separate construction gadgets in one strengthening or several buildings. A flat building is certainly one analogy, if you’re most other popular these include duplexes, triplexes, quadplexes, and you can blended-have fun with functions. Generally, HUD 223(f) finance are just available for multifamily qualities with 5+ uni

What exactly is a beneficial multifamily leasing assets?

A great multifamily leasing home is a residential building with several tools, particularly a flat building, duplexes, triplexes, quadplexes, mixed-utilized functions, and you may independent lifestyle institution. Less HUD loans, such as the FHA 203(b) financing, can also be financing step 1-cuatro tool services. HUD multifamily financing, such as for instance HUD 221(d)4 and you will HUD 223(f) financing, can be money flat property, mixed-utilized attributes (that have limitations for the amount of industrial area), and independent way of living units. Typically, HUD 223(f) money are just designed for multifamily features which have 5+ products. HUD 223(f) funds could also be used to own mixed-fool around with services, as long as commercial clients dont consume more 25% of web rentable area and do not build more than 20% of project’s productive revenues.

Exactly what are the benefits of committing to good multifamily leasing possessions?

The big benefit of investing in an excellent multifamily rental house is the fresh verify out-of legitimate monthly cash flow out of tenants. Because the multifamily features is rented over to multiple somebody otherwise group, there clearly was a reduced threat of opportunities – even when an occupant movements aside, you might greet rental money in the remaining occupied units. Concurrently, inside the an effective local rental markets, you’ll be able to complete openings fast, providing back to the original, higher income.

Investing in flat houses very early would be its beneficial. The obvious benefit ‘s the possibility large money returns. If you are multifamily properties are higher priced than simply single-family relations homes, they provide strong, good efficiency – also throughout the recessions in every however, some circumstances. On the other hand, committing to multifamily characteristics very early can help you take advantage of compounding production. Through the years, small quantities of currency invested into the multifamily functions can build significantly due to the strength of compounding output.

Specific landlords have discovered one to going for down-pricing multifamily features might help in manners. Very first, this new properties are usually affordable, and they is family several renters, which means more funds to you, that can be used to blow down the possessions quicker. Multifamily affordable homes is recognized as being a secure financial support to own dealers. The reason being these qualities are into the large consult. In many locations, it is difficult for people to cover the to find single-household members homes or even apartments. Even renting unmarried-relatives qualities is normally unthinkable. That have reasonable multifamily homes, even when, people offer casing to those who need they, making certain less opportunities.

Which are the dangers associated with investing good multifamily rental property?

There are numerous risks to consider when investing a multifamily rental possessions. Firstly, framework will set you back enjoys risen considerably over the past very long time, that will perception recovery really works. Make sure you shop around and you will bundle to come that have good solid finances before beginning apartment renovations to cease one unpleasant unexpected situations. Build waits also are a sad fact out-of lives, which tends to be best to take a highly conservative strategy with respect to your project schedule. As well, their restoration works may not be sufficient to discover the financial support lead you’re looking for. It’s also possible to purchase a great amount of financing to add the best-avoid luxury features in order to a house manufactured in the latest mid-eighties, however if potential tenants are searching for a more recent strengthening, you do not see much of an enthusiastic uptick within the occupancy or local rental revenue.

To get multifamily qualities is much higher priced than simply to purchase solitary-family relations belongings, ergo, it’s always hard to enter the sector since a first-big date a property buyer. While you are banking companies usually are wanting to provide finance, buyers will be able to have doing a 20% down payment, according to the market and/or measurements of the property.

Fundamentally, controlling a house will be requiring. Excessively day, currency, and effort, should be used on need such as for example maintenance, rent range, or renter assessment. So it’s constantly better to get a specialist administration company with the intention that your property is work at by elite group criteria.

What forms of resource are available for multifamily local rental features?

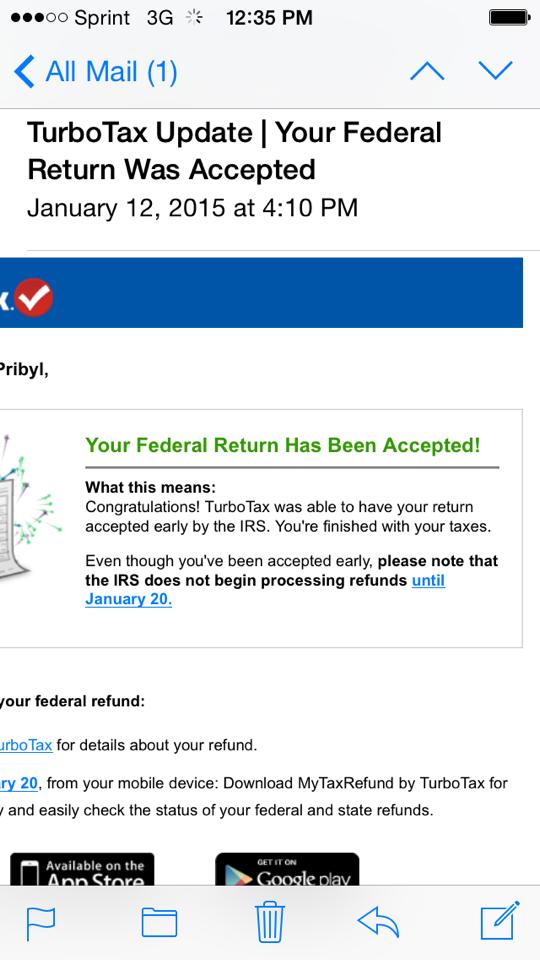

When an investor is looking at the qualities, he or she is probably going to be seeking old-fashioned mortgages which might be similar to what can be taken to have an individual-house. If you aren’t probably going to be surviving in our home and you will youre simply using they having an investment, conventional fund are the sole option nowadays.

But not, if you are planning is living in one of several tools to your possessions, it gets owner-occupied, that gives even more possibilities. In those times, you might also be able to play with Va finance otherwise FHA money since you are commercially still living on the possessions.

The kind of assets becoming funded also play a part in the money solutions. Like, luxury Oklahoma installment loans groups with high-end features can be more appealing to help you lenders and therefore possess significantly more good loan terms and conditions.

In sumily rental features is old-fashioned mortgage loans, Va fund, and you can FHA finance. The type of property and its particular places also can affect the mortgage terminology offered.

Which are the income tax implications off owning an excellent multifamily local rental assets?

Investing in multifamily attributes comes with multiple taxation bonuses. It’s possible to subtract functioning expenditures and maintenance costs, including administration costs, insurance coverage, and you can deals can cost you, otherwise any courtroom and you can elite services, including assets management organizations. With respect to financing development fees, training try fuel. Resource growth taxes is reduced while a beneficial taxpayer builds an income regarding losing a secured item such as for example commercial a residential property, ties, otherwise pricey collectibles. Financing growth taxes basically do not apply at typical individual and you can team income or the business of a person’s number 1 house.