Indeed, in certain points, refinancing could even harm debt wellness some times, detailed Koshy. Particularly, should you decide to buy property in the future, this circulate you will definitely laws difficulties with your overall financial situation.

It is because every time you submit an application for credit, the hard inquiry wil dramatically reduce your credit rating because of the a few situations. For many who upcoming unlock an alternative financing membership, it’ll lower the mediocre chronilogical age of your profile, that may plus decrease your credit score.

Refinancing the car mortgage cannot constantly generate financial feel. Part of the mistake you can make when it comes to refinancing was time.

Four strategies for taking ahead of refinancing

Based on Riba and you may Koshy, here are some tips to take before you re-finance your car or truck financing, when you are are alert to specific errors you can make.

Action #1: Now that you know the positives and negatives away from auto loan refinancing, make sure that you have every piece of information before you can accept a deal.

Action #2: Understand your current price, your loan terms and conditions and you can total can cost you if you keep the loans. Now, compare which as to the you’re available.

Action #3: Take into consideration the brand new depreciation of the automobile and you will possible transform on your state – instance looking for yet another automobile otherwise needing to sell the vehicle and you will move in.

Step #4: Understand how your bank tend to value your vehicle. An industry speed for an old auto can differ significantly and which worth will guide the speed for the loan.

Four problems to eliminate whenever refinancing

Refinancing your car or truck loan does not constantly generate monetary sense. An element of the error you are able to in terms of refinancing is timing. If any of your own after the circumstances apply at you, it may http://www.speedycashloan.net/payday-loans-il be beneficial to stick along with your latest mortgage.

Mistake #1: You might be far with each other on the unique loan’s cost: Through the amortization process, distributed away a loan to your a few repaired money, the desire fees gradually drop-off along side longevity of the borrowed funds. Thus, an effective re-finance enjoys even more possibility to spend less when you’re when you look at the the sooner amount from repaying the original mortgage.

Error #2: Their odometer are hitting large numbers: When you are riding an older vehicles with high usage, you will be regarding fortune. Really automobile loan providers enjoys minimal loan quantity and does not see it practical to help you point a loan towards the a motor vehicle who has notably depreciated during the worth.

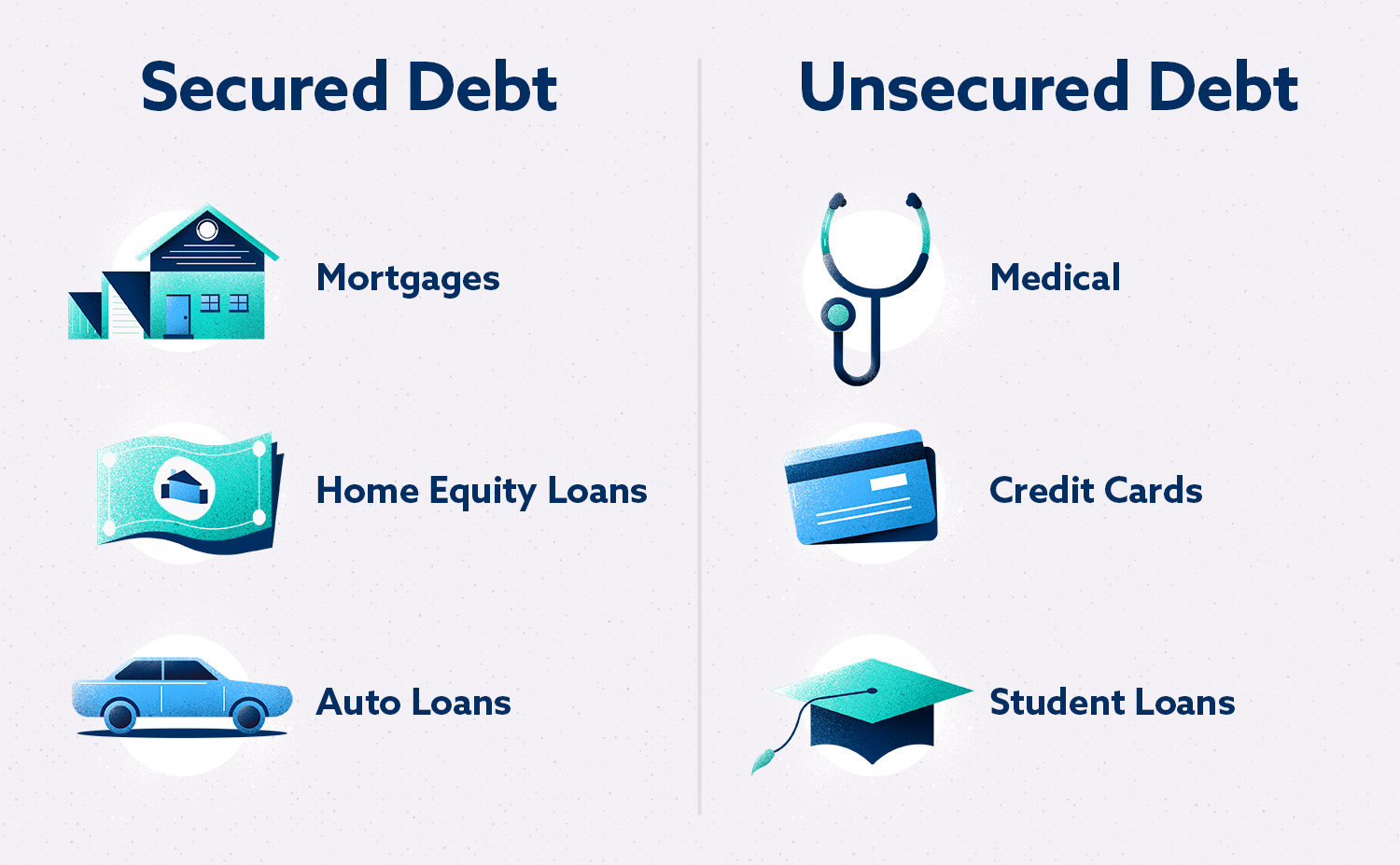

Mistake #3: You will be upside-down on the initial loan: Loan providers usually end refinancing in case the debtor owes more than the latest vehicle’s really worth (known as are underwater’).

Error #4: Your loan keeps a great prepayment penalty: Certain loan providers fees a punishment having repaying your vehicle mortgage very early. Before you re-finance the loan, check out the brand new terms of your existing mortgage with the intention that there are no prepayment charges.

Bottom line?

The main reason to look at refinancing is when you might meet the requirements getting a lower rate of interest and you may spend less regarding a lot of time work with. Theoretically, you could potentially refinance your vehicle loan anytime, even after you order the auto.

But based where you are regarding the fees agenda, their actual savings can differ. You can utilize an auto loan re-finance calculator, which happen to be freely available on the web, to perform the newest quantity for your disease to see how much cash refinancing could save you.

Should your interest rate on your own car is a lot higher than requested, imagine other options. Such as for instance, would it not sound right on the best way to grab a consumer loan and payoff the car, if for example the objective is to get out from the car finance fundamentally?

While doing so, contemplate exactly how much you will put away along side longevity of the mortgage. Even though obligations is not something to have to hold towards the, refinancing an auto loan to store a small amount of money more decade will most likely not create an abundance of experience.