Credit reporting Patterns

Just like the significantly more than facts and you can loads are acclimatized to assist influence their FICO get, your Vantage credit rating (a different type of credit scoring design) works out scores in another way. Vantage is additionally influenced by commission record, borrowing from the bank need, amount of credit score, credit combine and you will systems, and you may new credit, however the weights of any foundation disagree.

But, as the for every credit agency gathers and you can account guidance a bit in another way, it’s prominent for similar scoring model so you can however establish good mismatched result, dependent on which agency drawn the new client’s borrowing pointers. We will identify much more about one afterwards.

Vantage

Within the 2006, all three significant credit reporting agencies joined forces which will make this new VantageScore that is a special style of credit reporting model.VantageScore 4.0 is actually established in late 2017.

Vantage results certainly are the typical and you can accessible, therefore most people are available with the Vantage whenever checking their borrowing from the bank.

Beacon

A good Beacon Score is made from the Equifax Credit Bureau. Beacon try earlier labeled as Peak. Like many results, the largest issues that Beacon takes into account are percentage records Wauregan CT bad credit loan and profile owned.

Experian’s Federal Equivalency

That it rating model is made because of the Experian. The newest model has actually a few other rating range. Brand new 0-1000 assortment ‘s the rating assortment that was tasked whenever Experian’s National Equivalency was brought. Later, are similar to competition, Experian as well as reach render a choice rating list of 360 so you’re able to 840.

TransRisk

Created by Transunion, TransRisk, was developed based on study from TransUnion. It find one’s chance into the fresh new membership, in the place of existing profile. Because it’s particularly for this new account but a few lenders use it while looking for a clients credit history.

Vehicle World Option

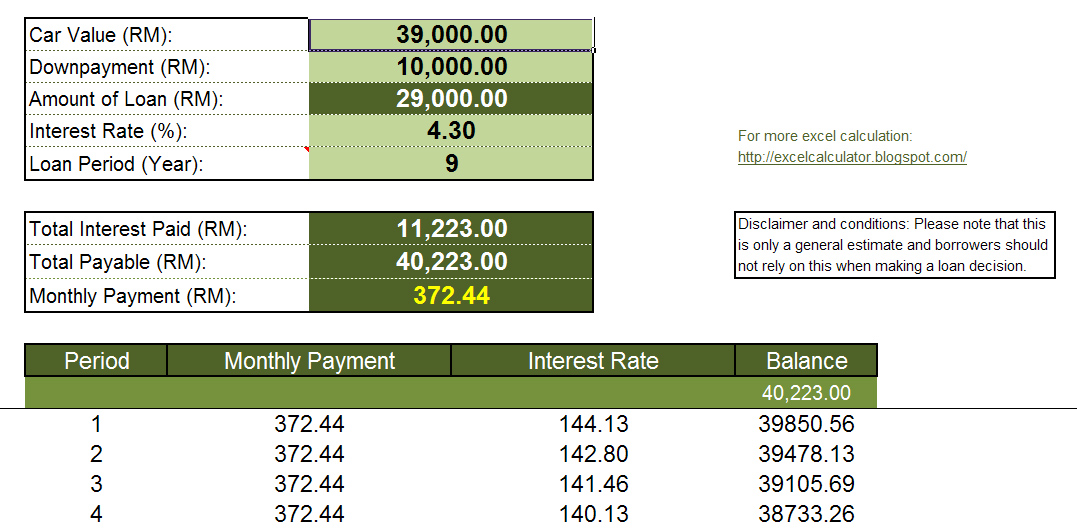

To choose a car credit rating, FICO very first calculates their typical credit rating. FICO after that produces an adjustment based on community-particular choices to produce automobile results. This can give lenders a far greater suggestion should you be able to make their car loan payments timely. FICO Automobile Scores commonly vary from 250 to 900 items.

Really lenders utilize the FICO credit reporting model that was dependent from inside the 1956 because of the Reasonable Isaac and you can Team. Today, there are lots of some other FICO rating designs that will be useful different varieties of personal debt. Such as for instance, there can be an alternative style of your own FICO get that is used for a home loan, charge card, car finance, and personal mortgage.

In reality, this past Oct, a special credit scoring design titled UltraFICO try brought and it’s a bit not the same as most of the anyone else.

What exactly is UltraFICO?

UltraFICO is an alternate FICO rating model that enables that enhance your own rating by using the examining and family savings data.

It means if you have no rating or a minimal borrowing rating, you’ve got a lot more choices to assist in they.

UltraFICO is definitely a game changer. Before, truly the only action which will raise your credit rating try expenses right back your debt you owe promptly and you can maintaining a healthy blend of accounts. They didn’t count what kind of cash you’d from the financial or even the fact that you paid their electric bills on time. Until now.

Just what UltraFICO Method for Your

Having UltraFICO, anybody can change your get performing things such as preserving money consistently over the years, which have a long-identity savings account, never permitting their checking account equilibrium wade bad, and you will expenses regular bills timely.

You only need to securely connect their checking, coupons, and/otherwise money business accounts. Then investigation which is amassed can boost the score from the indicating responsible financial conclusion.