Earnings Required for a 400k Home loan

Of numerous homebuyers was searching on $400k range consequently they are thinking if or not the income is satisfactory in order to be eligible for the loan. That it appears to be a common price range and you may suits in this the fresh new FHA loan restrictions each condition in america.

In this post, we will describe exactly what your income must be so you can afford a good $400k home loan and what details commonly feeling your ability in order to qualify.

Money needed for good $400k home loan is regarding $67k so you’re able to $78k a year dependant on hence home loan program you select, almost every other personal debt, fees and HOA charge.

For every mortgage program possess an alternate down-payment requirements and some possess a PMI demands while others do not. For those who have PMI, this means your revenue may need to end up being higher to cover a beneficial 400k mortgage since you have to beat you to definitely month-to-month PMI percentage.

Discover multiple apps you could potentially get to be eligible for an excellent $400k home loan. FHA, Old-fashioned, Virtual assistant and you may USDA require full income records. There are many more solutions that have larger down payment standards but in the place of money verification so you’re able to can get qualifying much easier.

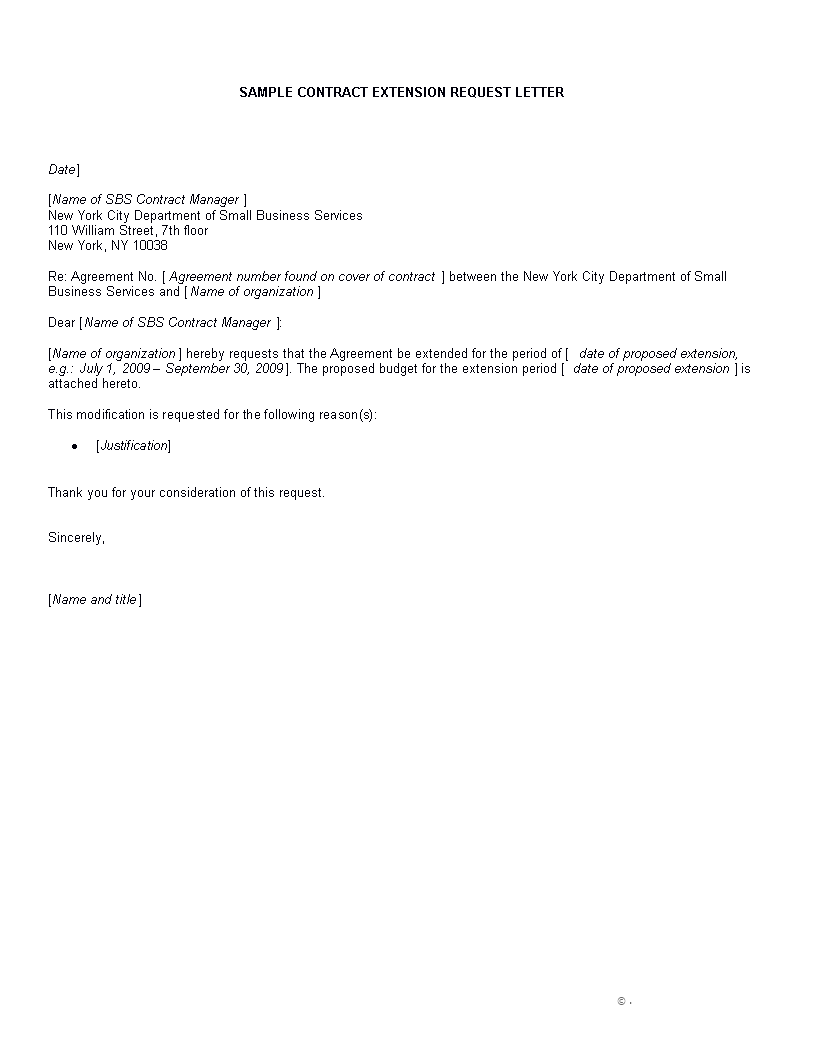

So it earnings needed for a $400k mortgage chart less than reveals the differences between home loan apps, advance payment, DTI requirement , and exactly how much money will become necessary for each no other loans.

- Tax speed of 1.5%

- Homeowner’s insurance premium of $1000 a year

- Interest rate of five.5%

- Few other the debt otherwise monthly premiums on the credit file

Please note you to a 20% down-payment to own a conventional mortgage is not needed, however, getting rid of new PMI by the putting down 20% leads to a lower yearly income needed seriously to qualify for a good $400k financial.

You will find several issues to consider of trying so you’re able to qualify getting a good 400k financial whatever the your revenue is.

Earliest, new yearly fees for the family you are seeking usually play a major part in the manner much income required to have good $400k financial. The higher this new taxes, the greater make an effort to secure to meet the requirements. This can be something you need to pay close attention to help you when thinking about their fee funds.

Therefore, if you’re in a position to look for homes the spot where the fees is lower, then chances are you do not need normally income so you’re able to qualify for a great $400k family.

2nd, while to get a home otherwise a flat having an enthusiastic HOA (homeowner’s relationship) fee, that also function just be sure to earn more in order to be considered. Homeowner’s association charge do eat on the how much cash you could potentially be eligible for.

From time to time, you may have to make 29% even more in order to afford property or a flat who’s got an association payment.

Finally, the borrowed funds system of your preference very commonly count. You will see throughout the chart you do not you desire because the most of an income while you are making an application for a good $400k FHA mortgage. Regardless of if all FHA funds possess a month-to-month mortgage insurance rates fee, the fresh deductible DTI is significantly high and that means you can afford so much more.

How-to Be eligible for an effective $400k Home loan

Before completing a software, think about what funds otherwise commission you are confident with. 2nd, see what your offers you have got to have a downpayment and you will settlement costs.

The borrowed funds manager goes due to various certification requirements and additionally work, job stability, your deals, and you will credit history. Make an effort to supply thirty days from view stubs, a couple months financial comments, couple of years off W2’s and 2 yrs of taxation statements.

If you would like observe simply how much you could potentially qualify getting, have fun with the house Affordability Calculator to greatly help dictate you to to you personally. The fresh calculator will need your loan places Silverado income, financial obligation, future household taxation and insurance rates to include an easy estimate having your.

First time home buyers usually you need people to help book all of them from means of to invest in a property or even delivering pre-licensed. You will want to speak with a loan manager well before your meet with a real estate agent in order to trip homes.

Our partner bank may have initially discussions with you get a hold of where you stand during the being qualified to have a home loan and to determine if one thing particularly credit ratings otherwise downpayment needs as done.

Frequently asked questions

Just what things do loan providers thought whenever determining money to own good $400,000 home loan? Loan providers will at the earnings, debt, proposed taxes and you can insurance policies for the assets, and you will latest interest levels whenever choosing if you could potentially qualify for a great $400k financial.

Are there certain loans-to-income ratios that have to be came across? Your debt so you’re able to earnings rates are very different reliant the mortgage program additionally the lender. FHA funds particularly will allow as much as good 56.9% DTI with good credit.

Do i need to include my wife or husband’s money when calculating the amount of money necessary getting an effective $eight hundred,000 mortgage? Contain the spouses earnings nonetheless it should be completely reported.

Do loan providers has actually additional criteria for different brand of mortgage loans? Lenders could have some other conditions for other mortgages that will perhaps not require earnings papers.

How does credit history change the earnings criteria to possess a $eight hundred,000 mortgage? Credit ratings impact the money called for because your ratings determine brand new interest rate offered. The reduced the interest rate, the faster earnings you would have to meet the requirements.

Must i fool around with local rental income within my personal being qualified income? You need local rental income in your being qualified money if it rental money is reflected in your tax statements. You’ll must also are people home loan, tax and you can insurance rates repayments on leasing property to the loans edge of your application.

Are there any certified mortgage software having different earnings conditions? You can find stated earnings funds that do not require that you confirm your earnings.