Into correct people, build financing is a lot easier than simply do you believe. Here is how.

Homeseekers tend to think that building another type of house is maybe not an enthusiastic choice if they do not have cash to construct a home and you will are expenses a home loan to their existing family. Anyway, who wants to shell out several mortgages in the framework procedure?

Thankfully, you’ll find solutions readily available one slow down the count you will have to spend when you find yourself your brand new house is are created and make clear the new procedure for qualifying for a financial loan to fund building your ideal household.

End taking right out a conventional mortgage on your own

One of the biggest homebuilding difficulties just in case you have a mortgage is actually thinking they should take out a special old-fashioned home loan for their new home. If you find yourself strengthening a property, or even purchasing a great pre-construction house, a normal financial isn’t the correct alternative. Taking a conventional mortgage might possibly installment loan Louisiane be tough, especially if you attempt to take action oneself, as lenders are unwilling to financing money getting property one to is not yet based. Hence, it is best to safer a loan tool designed for this new family structure.

The TJH class allows you to choose the best family service and link you to definitely investment options to be able.

Instead, receive a houses-to-long lasting loan

Construction-to-permanent financing regarding a great TJH common financial, such as for example Kinecta Federal Borrowing from the bank Connection, get rid of the have to pay a couple mortgages when you find yourself your new house has been depending.* Costs be more sensible as they are interest-merely, according to the an excellent loan amount. Through the draw process, the lender disperses investment to help you TJH as advances is done on your home. Immediately following a final house assessment and/or certificate from occupancy, the loan converts in order to a home loan and dominant costs start.

One of the primary issues we come across would be the fact most people consider they should be eligible for one or two belongings and you can shell out one or two mortgages. The truth is they will not have to generate a mortgage percentage on brand new home up until it’s complete. At the time, they can sell the existing house thereby applying you to count towards the new loan.

Squeeze into a loan provider you to specializes in home building

If you obtain regarding a loan provider that’s beginner during the homebuilding, you may want to get a second financing closing for the financial from the a higher interest after you reside done.

The common lenders offer structure-to-long lasting financing with a one-time near to protect your rates. Because of this, you save thousands inside the a lot more closing costs.

Loan providers for example Kinecta as well as boost the interest rate in advance of framework begins, and therefore speed will continue to be a comparable as the financing turns in order to a vintage home loan. Therefore, you don’t need to value interest rate nature hikes causing a high-than-expected monthly payment in your new home. You know exactly what you are going to spend regarding the structure phase and you may immediately following disperse-within the.

Select a the right mortgage for your house create

So you’re able to loans building the place to find your own hopes and dreams, you will need financing you to definitely goes beyond what exactly is supplied by antique mortgages. With the prominent loan providers, you could have usage of the best household, correct the place you need it, together with financing you need to get there.

Our preferred loan providers promote collection jumbo fund, which are alot more versatile, basically on much lower rates, than simply compliant money that has to adhere to the factors put in set because of the Freddie Mac computer and you may Fannie mae.

All of our popular loan providers in addition to run clients to find the proper home loan and you can conditions because of their certain problem. They provide financial support according to research by the upcoming appraised property value your own family just after it is dependent, that may lead to down costs, according to appraised worth proportion toward established financial dominant.

Go for a conclusion-to-end provider

Securing a casing-to-long lasting mortgage shall be a difficult techniques, requiring homeseekers to prove their home-strengthening venture is low-risk on bank. TJH’s reputable construction times, price be sure, end-to-stop techniques, and you will reputation given that largest single-package, replacement homebuilder in the country provide loan providers an abundance of coverage in greenlighting any project.

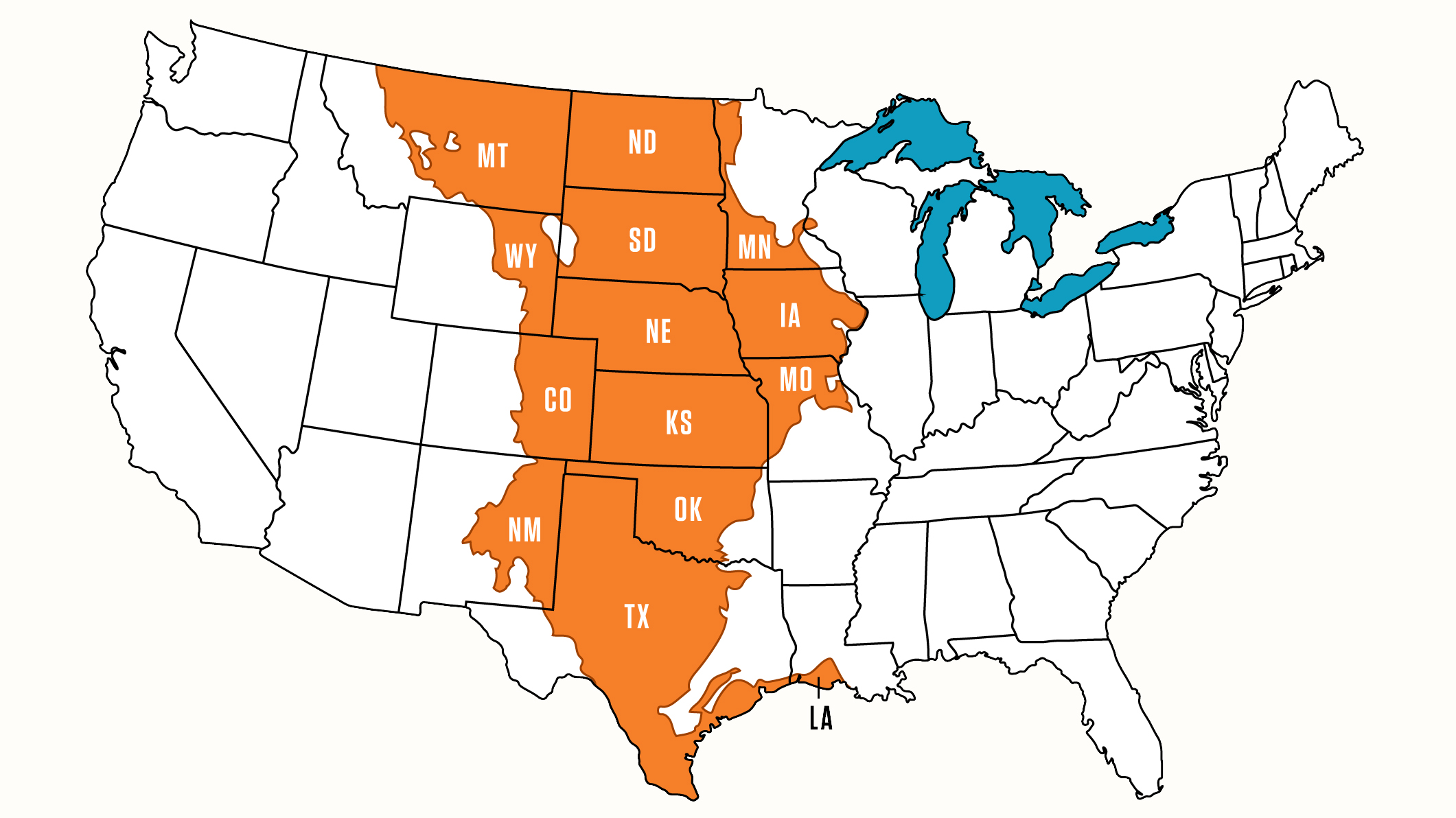

I have home concierge characteristics for these shopping for a great lot otherwise homesite on best areas in the Southern area California, North California, the newest Pacific Northwest, Tx, and Washington. We will look for you an off-field property on which to construct your house for individuals who dont have a great homesite. Our very own popular lenders give framework money that will range from the prices of the end up in your loan, getting rid of the necessity to safer another type of belongings mortgage.

Capital a beneficial TJH household build is easier plus doable than simply of a lot read. We offer an almost all-in-you to financing having a single-go out personal. This prevents the stress and you will pricey purchase charge generally speaking regarding the independent construction-to-long lasting rollover loans. Instead, the process is equivalent to a vintage mortgage, only before our house getting founded.

*Kinecta Government Borrowing Connection and Thomas James Home are not connected. Membership requirements apply. NMLS (Across the country Mortgage Financing Services) ID: 407870. Subject to credit and you can assets acceptance. Costs, program terms, and you may criteria are subject to change without warning. Never assume all goods are obtainable in all states and also for all mortgage quantity. Almost every other constraints and you will limits may use. The actual regards to the borrowed funds all hangs abreast of the particular attributes of loan transaction, the fresh applicant’s credit history, and other economic items that may use.