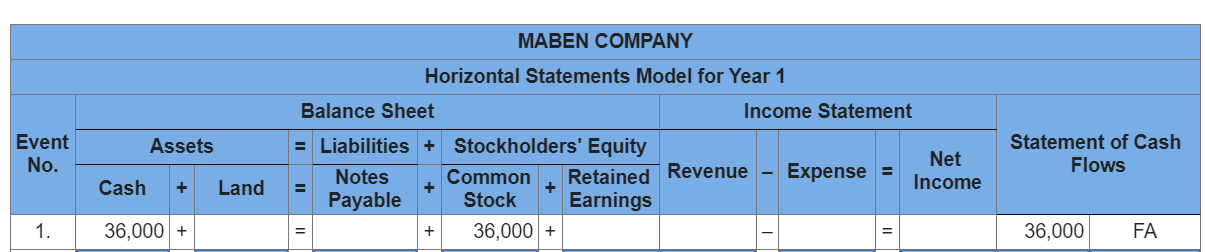

Wanting a quicker, much easier way to re-finance your FHA loan? An enthusiastic FHA Streamline Re-finance might help. An FHA Improve Re-finance has the $255 payday loans online same day New Jersey benefit of a more quickly, less costly selection for latest FHA consumers seeking refinance so you can a unique FHA mortgage. That means faster records, less costs, and less date waiting around for underwriting to examine your loan software.

What exactly is an enthusiastic FHA Improve Re-finance?

FHA Improve Refinance is a loan designed by the brand new Government Houses Administration to help people make FHA financial less costly rather than the duty of a thorough qualification techniques. Smoother degree means a less strenuous, much easier procedure for your requirements, the new citizen.

As well as, its a victory-win on the FHA. Simply because they currently ensure your mortgage, it presume there’s a lesser possibility which you yourself can standard. Meanwhile, they’re letting you get a good, less expensive mortgage.

What are the pros?

The latest FHA’s streamline refinance system is loaded with masters for individuals who be considered. Let me reveal a quick number to present an idea:

- Decrease your speed and you will/otherwise commission as you perform with a conventional financial re-finance.

- Considering given that a five-seasons varying-rates mortgage (ARM) otherwise since the a predetermined-price mortgage which have an expression away from 15, 20, 25, otherwise 3 decades.

- Lower borrowing from the bank conditions.

- Limited records. That implies zero money standards, no proof a career, zero paying up financial statements, with no house verification expected.

- Zero family equity? No problem. Unlimited LTV function you will be however eligible even if you have little if any guarantee in your home.

- No appraisal requisite.

How come an FHA Improve functions?

Needless to say, just like any currency your acquire, some limits pertain. For starters, there needs to be a showed internet tangible work for in the a beneficial FHA Improve Re-finance transaction. Internet real benefit form you could simply do an enthusiastic FHA Improve Re-finance if this masters you. Create an effective FHA Streamline Refinance decrease your interest rate? Wouldn’t it move your existing financial regarding an arm so you can a beneficial fixed-rate financing? Put differently, would it leave you for the a better standing than before? Great! That’s the form of borrower the fresh new FHA is looking to serve through its FHA Improve Re-finance program.

You simply can’t improve loan equilibrium to cover refinancing can cost you and you may your new loan try not to go beyond the original home loan amount. When you do an excellent FHA Improve Refinance, your brand-new loan amount is restricted to the present prominent equilibrium plus the upfront mortgage premium. It means possible often have to pay closing costs from pouch or score good no-cost mortgage. And really, no-cost is to indeed feel named zero away-of-pouch costs since it means your lender believes to pay the brand new settlement costs for folks who invest in pay a higher rate of interest.

What are the downsides?

If the providing cash-out in your home security is the purpose, a keen FHA Improve Refi may possibly not be best for you. As to why? Since you can’t get more than simply $five hundred money back to own slight improvements in conclusion can cost you.

Such as your brand spanking new FHA loan, an FHA Streamline Re-finance nonetheless needs you to shell out mortgage insurance policies in a single-date, upfront mortgage advanced, which you spend at closure, and you will a monthly home loan insurance payment.

How to meet the requirements?

The financial have to be most recent (perhaps not outstanding) after you make an application for your own FHA Improve Re-finance. You might be simply allowed to generate one late commission on your latest FHA home loan previously year. As well as on greatest of the, your mortgage repayments during the last half a year have to have started produced inside 1 month of the deadline. While the FHA Streamline Refinances want less confirmation, this type of commission history will show your lender additionally the FHA that one can responsibly pay-off your current financial.

Ultimately, you must have generated at the very least half a dozen monthly installments on financial getting refinanced, together with six current costs should have become produced to the date. Likewise, at the very least six months must have introduced as the earliest fee due. At the very least 210 months have to have enacted because the big date your closed.

The bottom line

It is important to keep in mind on the an enthusiastic FHA Improve Re-finance is you can only qualify for it loan when you’re refinancing your current FHA mortgage to a new FHA financial. When you are refinancing so you can otherwise of a different sort of mortgage method of, this 1 isnt available. Thankfully one to since you already qualified for a keen FHA loan once you purchased your home, its almost secured you are able to qualify for a separate FHA mortgage when you refinance.