This is the time to help you unlock do-it-yourself info which have a good 2nd home loan. Its a good time in order to safe reasonable next home loan cost for your home restorations opportunity. Explore an extra home loan t0 take advantage of investment incentives out-of top loan providers giving popular home guarantee mortgage programs now. We obtain individuals inquiring people the time, Do you take out a second home loan for renovations? Today, of numerous smart residents is actually taking out fully 2nd mortgages and you can HELOCs having an incredible number of do-it-yourself projects nationwide, so why don’t we take a few momemts to see why.

Ways to get an additional Mortgage to have Renovations and you will Remodeling

This new RefiGuide has been doing lookup for you in which banks, borrowing from the bank unions, 2nd lenders and you can brokers are offering aggressive second mortgages to own do-it-yourself, recovery, treatment and you will design funding. If you’d like a 2nd home loan to have upgrade otherwise very first household improvements, now’s a great time get approved getting a reasonable equity loan otherwise versatile HELOC line of credit.

Most property in the us are ordered with a home loan. When you have a mortgage, you probably possess some security on the possessions, therefore you should consider bringing another financial. This is certainly nearly needless to say the situation from inside the 2024 while the domestic opinions are nevertheless peaking close record levels.

For many years, the second financial has been a greatest financial support unit to have homeowners to help you remodel otherwise rehabilitate their house. Of a lot economic advisors highly recommend a 2nd mortgage to own house remodeling for of several valid grounds, therefore let us tell you as to the reasons.

Apply for an extra Mortgage to have Renovations, Restorations, Cash-out and more

Perhaps one of the most preferred sources of the cash accomplish a home remodel was home collateral. Of a lot homeowners find a cash out re-finance and you will second mortgage funds are the finest option for house home improvements and you can structure.

The reason being you are having fun with element of their home’s well worth to compliment the significance after that. As many renovations raise a good house’s worth, such second mortgage loans would be a great way to change your profit.

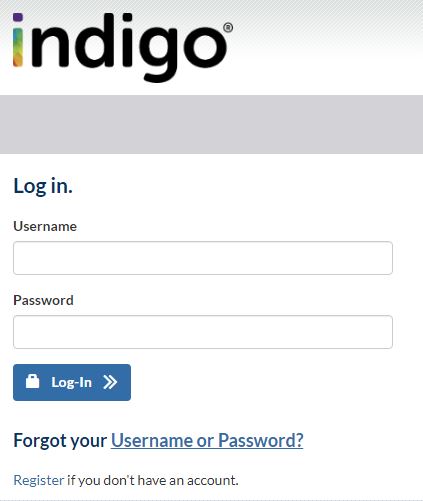

Taking a second financial have not imply far more accessible having technology dancing and you may loan providers giving home collateral finance by smartphone into the times.

Of numerous homeowners realize that playing with guarantee to boost the benefits of the home will help these to use the the new security created to buy that which was borrowed. This may just help you when you promote the home, but nevertheless, it can be an excellent flow. House equity finance are a great way to possess people to get into bucks easily at a reasonable rate of interest.

House repair methods are receiving more common, and regarding the 50% of all the domestic-equity Indianapolis loans financial support is used for this function. It is a fact you to undertaking a property recovery venture which have domestic collateral makes sense, however, there are methods which can shell out your most useful for the the long run than others.

Greatest Reasons why you should Get a second Mortgage having House Building work

Additionally, 62% regarding American home owners that happen to be renovating decide to remain in the property having 11 or higher age, an increase regarding 59% in the past seasons.

One exact same questionnaire showed that Western individuals are so much more willing to create sacrifices to locate sensible homes, because the 34% told you they would like to buy an excellent fixer-upper and make renovations.

This user request is operating finance companies and lenders to help you declare so much more affordable and a lot more aggressive next mortgage applications and come up with money domestic improvements much easier than ever before.

Here are some benefits and you may a few from the getting good domestic guarantee loan otherwise second financial to possess a home redesign: