Many situations come into play when making an application for a home loan. Lenders weighing your credit rating greatly because it shows your ability to repay finance punctually. Most people understand that a good credit score advances the chance of qualifying for a minimal-focus mortgage, but what credit history do you want to get a house? The answer relies on the kind of mortgage you’re seeking.

What Identifies Your credit rating?

There are numerous an approach to estimate a credit rating. For this reason the number may vary somewhat on your credit report out-of all the biggest national credit reporting agencies-Equifax, Experian, and you will TransUnion. More advanced and really-recognized credit scoring method is the new FICO Rating. FICO, created by the new Reasonable Isaac Agency, compiles details out-of every around three credit reporting agencies to help you determine your get. These types of variables and their involved value are:

- Percentage record (35%)

- Overall financial obligation owed (30%)

- Duration of credit score (15%)

- Types of credit (10%)

- The brand new credit lines (10%)

Lowest Credit ratings by the Mortgage Types of

Your credit rating, hence countries approximately three hundred and you can 850, means your creditworthiness. Some thing lower than 630 is recognized as poor credit, while a rating a lot more than 720 means you may have expert credit. Let me reveal a review of exactly what credit score is needed a variety of sort of lenders:

- Antique lenders proceed with the criteria set of the Federal national mortgage association and you will Freddie Mac and generally are maybe not covered from the any authorities company. Ergo, the application may be denied if your credit score is gloomier than just 620. Old-fashioned funds are typically good for homebuyers which have a or higher level credit and gives a decreased rates of interest and more than flexible fees choices for people who qualify.

- FHA home loans are covered of the Federal Casing Management. Therefore, he could be safer for lenders and much easier so you’re able to be eligible for than just old-fashioned money. You want a minimum credit score away from 580 if you make a down-payment out-of only step three.5%. For people who set-out at the least 10%, you may be eligible for an enthusiastic FHA financing which have an amount all the way down credit score.

- Va home loans try backed by brand new Institution out of Pros Circumstances and require no down payment, making them a viable solution when you’re an armed forces services user, experienced, or qualifying companion. There’s absolutely no globe-set minimal credit rating, but most lenders like to see a rating away from 580 otherwise higher.

- USDA mortgage brokers is actually backed by the fresh new Agency out-of Agriculture’s Rural Casing Solution. In order to qualify, you need to purchase a rural or suburban household and you may secure less than 115% of town average money. Certain lenders accept credit ratings only 620, but a rating off 640 or even more is perfect.

Is it possible you Get a mortgage having Less than perfect credit?

You will be able, although more challenging, to help you qualify for a mortgage in case your credit rating try lower than minimal requirements. Anyway, poor credit implies that you commonly dish upwards personal debt or skip monthly premiums, leading you to an excellent riskier borrower. To aid offset it risk, lenders can charge a high interest otherwise need a more impressive downpayment. Because of this, you are able to be eligible for home financing that have bad credit, however you will need to pay a whole lot more for it.

How to Alter your Credit history Before applying to possess a home loan

In case the credit score actually right, you may have to provide it with an improve prior to purchasing a good family. Here’s how:

Exactly what Else Would Loan providers Believe?

Once the you take a couple months to evolve your credit score, consider what other factors affect your financial application. You might be able to make loans in Bonanza improvements in these parts given that better to further boost the odds of qualifying to own a reduced-desire financial.

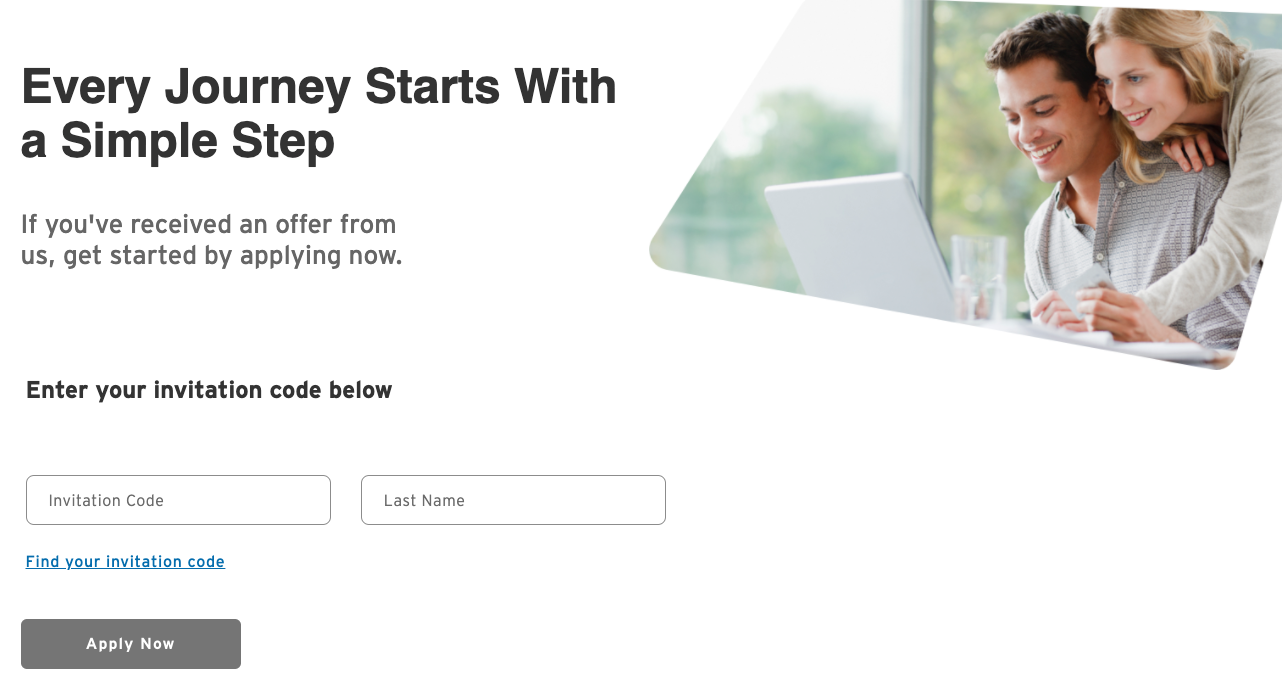

Get Pre-Acknowledged to possess a mortgage Today

Within Economic Axioms Home loan, we need you to allow. This is exactly why i encourage one improve your credit rating before making an application for home financing. If you are not yes what sort of financial is useful having your, our very own the financing benefits can also be walk you through the choices. Delight call us within (405) 722-5626 or begin the new pre-acceptance process on line today. We are proud to get a locally had financial bank offering Oklahoma, Tx, Ohio, Arkansas, and you will Alabama.