Your score drops for the set of score, from 300 so you’re able to 579, considered Sub-standard. An excellent 520 FICO Rating is significantly underneath the average credit history.

Of many loan providers like not to work with borrowers whose scores belong ab muscles Terrible variety, towards grounds he has got negative credit. Credit card applicants which have scores inside assortment may be required to pay most charge or even to put down deposits on their cards. Energy people also can require these to place safety dumps on devices otherwise solution agreements.

More or less 62% of users with fico scores less than 579 are likely to getting absolutely outstanding (i.age., wade more than 3 months past due into an obligations percentage) in the future.

Tips replace your 520 Credit rating

Brand new bad news concerning your FICO Get of 520 would be the fact it is really underneath the mediocre credit rating away from 714. Luckily for us that there is a good amount of possible opportunity to boost your own get.

A simple way to start gathering a credit score is to find your FICO Score. Plus the score in itself, you are getting a claim that distills the main occurrences within the your credit history that are cutting your score. For the reason that it info is drawn right from your credit score, it does pinpoint products you can deal with to assist boost your credit score.

Getting past a less than https://paydayloanalabama.com/fultondale/ perfect credit rating

FICO Results regarding the Very poor diversity usually mirror a reputation borrowing from the bank missteps otherwise mistakes, particularly numerous skipped otherwise later repayments, defaulted otherwise foreclosed loans, and even personal bankruptcy.

Certainly one of users having FICO Many 520, 19% possess borrowing records that mirror that have moved 29 or more months overdue on a payment over the last 10 years.

Once you happen to be used to your credit history, the contents as well as their impact on their credit ratings, you could start getting strategies to produce the borrowing. As your credit practices improve, your own credit scores are going to realize match.

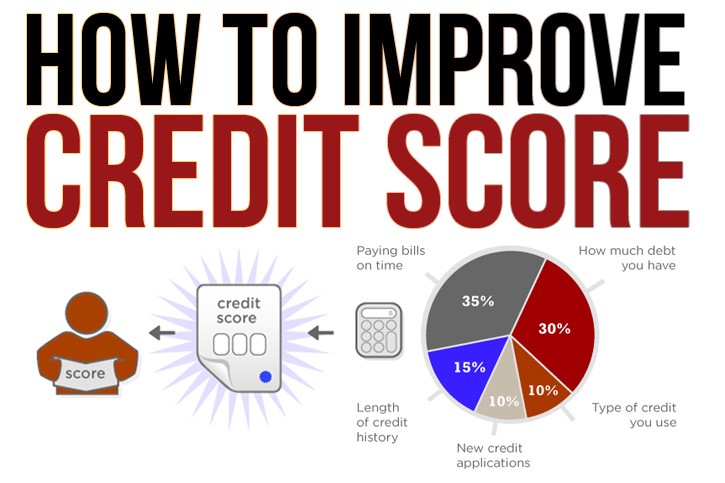

What influences your credit score

/cloudfront-us-east-1.images.arcpublishing.com/gray/3FI6M36YTVPFBHIVUACOPEXE7I.jpg)

While it’s good for know the particular behavior in your credit rating, the sorts of routines that lower your credit history are well-known generally speaking conditions. Information all of them makes it possible to attention your credit score-strengthening methods:

Public records: In the event the bankruptcies or any other public records appear on your credit report, they generally hurt your credit rating honestly. Paying down the newest liens or judgments from the first possibility can reduce the perception, however in the outcome from bankruptcy proceeding, only day can lessen their harmful effects on the credit scores. A part eight bankruptcy will stay on your own credit report for as much as ten years, and you can a chapter 13 case of bankruptcy will stay here having seven years. Even when your credit score may turn to recover ages in advance of a bankruptcy drops of the credit file, specific lenders could possibly get decline to help as long as you will find a bankruptcy on the checklist.

Borrowing from the bank utilization price. In order to determine the financing use price into the credit cards, divide the fresh new a fantastic equilibrium from the card’s borrowing limit, and you may proliferate because of the 100 discover a share. In order to determine your general usage rate, seem sensible the fresh stability into the all your handmade cards and you will divide by the sum of the credit restrictions. Very it is strongly suggested remaining utilization lower than 30%, for the a credit-by-credit basis and you may overall, to stop injuring your credit score. Application rate contributes up to 31% of the FICO Score.

Late or overlooked money. Purchasing bills consistently and on go out is the solitary smartest thing you can do to market good credit. This may take into account more than a 3rd (35%) of one’s FICO Get.