Accessibility which design RBPN is suitable whenever no credit get is used setting the information presented regards to borrowing from the bank

To your , the fresh Government Reserve Board (FRB) and Federal Exchange Payment (FTC) published a final rule including requirements to the Fair Credit scoring Operate (FCRA) Risk-Dependent Pricing regulations which have been active . This short article features the new criteria followed according to the Dodd-Honest Wall structure Path Change and Consumer Safeguards Act (Dodd-Frank) and you will reviews FCRA exposure-depending costs notice (RBPN) requirements hence continue steadily to make questions.

Pursuant towards FCRA, a customers must discovered a RBPN if the a customer statement is utilized in experience of an application, give, extension or any other provision off credit and you can, located in entire or in region into the individual statement, the credit is actually granted, stretched, or given toward topic terminology which might be materially smaller favorable than many beneficial words offered to a substantial proportion out-of consumers.

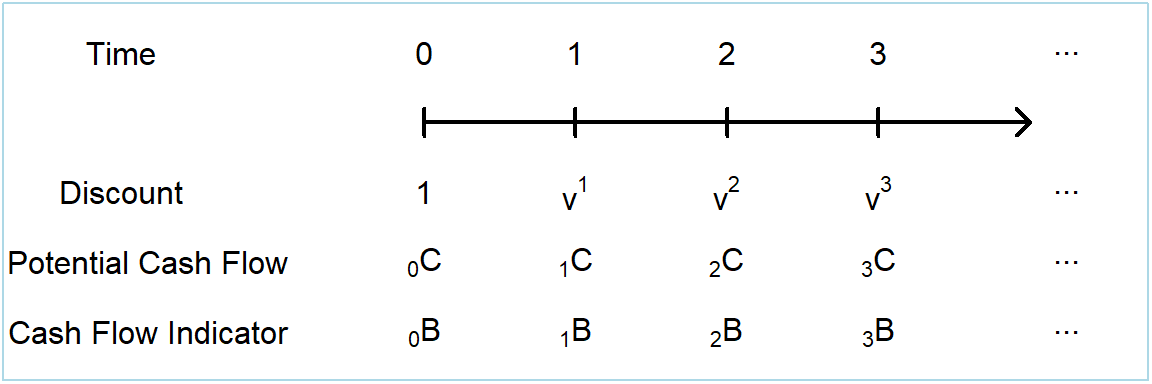

The form, stuff, time and technique of delivery of needed RBPN were addressed by the FRB and you may FTC in early 2010. One first rulemaking provided a few solution manner in which mortgage brokers could possibly get determine when they’re involved with chance-mainly based cost. On purposes of which conversation, why don’t we suppose brand new creditor engages in risk-created costs, identified as the technique of means the cost and you will/or other terms of credit accessible to a particular user so you can mirror the possibility of nonpayment from the that consumer.

As required by the Dodd-Frank, the fresh signal typed the other day needs financial institutions to include even more disclosures from the RBPN when the a customer’s credit history is utilized into the function the materials regards to borrowing.

The new RBPN should be provided if one uses a customer declaration in connection with credit priily, otherwise home intentions; and you may, based in whole or even in area towards the individual report, will bring borrowing from the bank to this consumer on the thing terms and conditions that will be materially faster favorable compared to the very positive conditions open to a hefty proportion out of people.

In order to decide which customers have received credit on the thing terms that are materially smaller beneficial as compared to really advantageous terminology available to a hefty proportion regarding users, which need to discovered a online installment loans Ohio beneficial RBPN, loan providers will get utilize among the many following the methods:

Circumstances of the Circumstances BasisThis method needs financial institutions to compare procedure conditions open to each user while the situation terms available to most other people to own a certain form of borrowing device.

Credit history Proxy This process needs creditors to select the borrowing from the bank score that means the point where approximately 40% of users so you can whom it features, extends or brings borrowing has highest credit scores and as much as 60% of users so you’re able to just who they features, runs or will bring credit have down credit ratings, and provide a notice to every individual to whom it offers, stretches otherwise brings borrowing whoever credit rating is leaner than the cutoff.

Here are tips concerning your RBPN standards generally, brand new newly required additional disclosures, additionally the exception to your standard code to own fund covered of the domestic property if a real Credit score Disclosure Difference Notice is provided to candidates

Tiered Cost Creditors who set users within one off a distinct number of rates sections for a particular particular credit device, ought to provide a risk-based pricing notice to each individual who isn’t set within the top prices tier otherwise levels (when the four off a lot fewer levels, every that do maybe not be eligible for position from inside the greatest tier we.elizabeth. best deal); in the event the five or maybe more tiers, every who do maybe not qualify for placement when you look at the ideal a few sections.

ContentModel versions can be found in the newest appendix of FCRA, the usage which provides a secure harbor having conformity. The latest RBPN need to tend to be seven particular statements delivering facts about consumer profile, the technique of risk-founded pricing and particular individual liberties. Towards the complete variety of criteria discover Control Z, 12 CFR (a) (1) (i-viii). Design Function H-step one contains so it called for recommendations.