Willing to improve relocate to another type of family? Connection capital would be a fashionable choice to the newest logistical and you will financial challenges regarding transitioning from your own dated into new house.

Too many solutions

Purchasing your first place can be enjoyable and you can frightening, nevertheless strategies, at the very least, are pretty straight forward. Shop, generate an offer, provide see on property owner, personal and you may circulate. Alas, the latest logistics regarding a shift after you currently very own a house aren’t as easy. And many of your own prospective paths forward shall be shorter-than-tempting.

Record your current family for sale and you will taking a step regarding faith the prime new house tend to to enter the market was you to alternative… exactly what if for example the correct domestic will not arrive over the years? You could end up scrambling for meantime homes.

Or even require pressure when trying to help you dovetail new timing of your revenue and buy, you could plan on moving twice. Place your posts when you look at the sites and you will book accommodations whenever you are ranging from house. But swinging is not fun – and you can moving twice (regardless if its arranged) is twice as much dilemma and you may debts.

Another option is to try to wait towards the checklist cash advance Genoa Genoa, CO your property up until you find where you are interested. If the perfect new home occurs, include a backup to possess attempting to sell your current household on your offer. Sounds effortless adequate. But, however, their seller must be happy to undertake a contingency. Many are not – specifically if you try fighting up against almost every other now offers.

Buy first, up coming sell

An obvious response is in order to decouple the newest time of your own pick and marketing by purchasing your brand new household prior to promoting their dated family. The new strategies of disperse score a good heck of many simpler. Go shopping for the right spot, establish an effective (non-contingent) give, intimate, get your tactics and come up with the flow at the relaxation. Up coming ready yourself, stage, number market your own old family. Simple peasy.

Or perhaps maybe not… all of the collateral on your old house is nonetheless tied up and you will not available to put upon your new domestic unless you promote. If you fail to find an alternative way to obtain financial support for your downpayment, you are to rectangular that.

What is a connection financing?

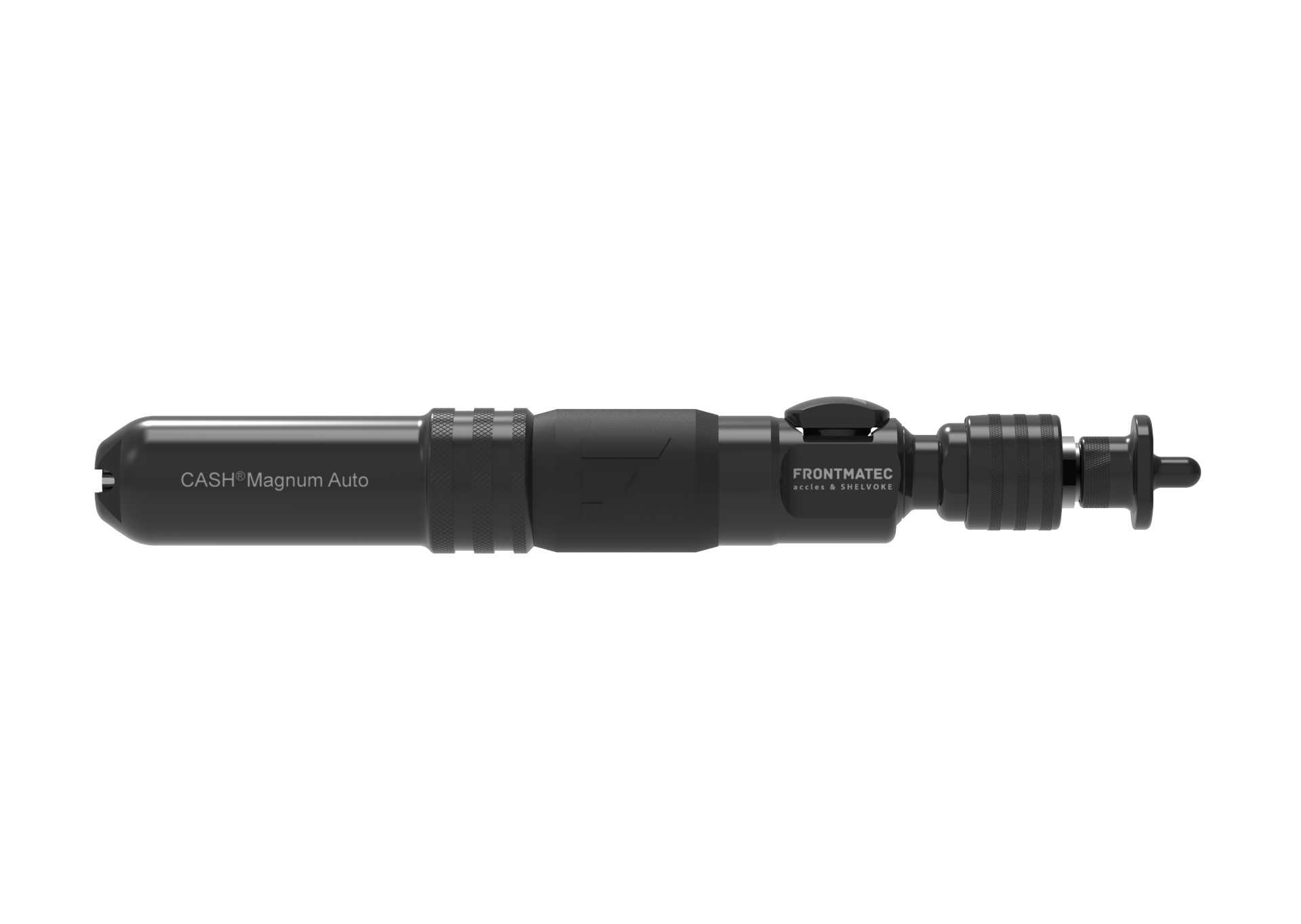

![]()

Having fun with a link loan, you happen to be able to leverage the new collateral on your own most recent home to buy your new house. For those who have adequate guarantee on your own old home, you may have the choice to purchase your new home with no dollars downpayment.

How does they functions?

This is certainly called cross-collateralization. The lender spends both your own old and you may new house once the guarantee for the home loan, and that means you rating borrowing from the bank with the collateral throughout the old assets on the the purchase of your own the brand new possessions.

An illustration

Imagine if your existing house well worth is actually $five hundred,000 and you are obligated to pay $100,000 on the financial and you will $50,000 on the property collateral credit line. We should purchase an excellent $700,000 household. You’ve been living in your own old home and plan to circulate into the new home The latest math goes such as this:

That have $750,000 available equity, you can fund an excellent $700,000 no bucks down-payment required. The brand new $50,000 of even more available collateral can be used to fund their settlement costs.

Spreadsheet run the number!

Must experiment with your own number? Utilize this convenient spreadsheet observe how bridge money might pencil aside for you.

Plan for the newest meantime

While using the a link loan, don’t forget to policy for the unavoidable interim windows of time whenever you’ll be able to own a few homes. You will have to carry the cost of each other land from the time your close toward acquisition of your brand new house up until your day your close to the purchases of one’s old family.